Do you have prescriptions and medications you need covered? Let's learn about Medicare Part D and how it works.

Medicare Part A and Part B cover medications related to specific covered services. For most other prescriptions, including those taken at home, Medicare Part D is necessary. Part D may also cover certain medications administered by professionals in outpatient settings, such as injections or infusions.

Here’s a summary of what Medicare Part D typically includes:

Note that Medicare Part D does not cover over-the-counter medications, vitamins, or other non-prescription drugs.

Whether you select a standalone Medicare Prescription Drug Plan (PDP) or a Medicare Advantage Prescription Drug Plan (MAPD), key features such as pharmacy networks and formularies will remain similar.

Pharmacy Networks: These are lists of pharmacies where you can fill your prescriptions. They generally include preferred pharmacies that offer lower prices, as well as standard pharmacies. Many plans also offer mail-order pharmacies, which can provide additional savings on medications.

Formularies: This refers to the list of medications covered by your plan. Formularies can vary significantly; some plans may cover mostly generic drugs with a few brand-name options, while others offer more extensive coverage, including a wider range of brand-name medications, often accompanied by higher premiums.

Book a free call by clicking or tapping below or give me a call at: 727-513-2767

Once you enroll in a Medicare Part D plan, your coverage will follow a four-stage process:

Deductible: This is the amount you must pay out-of-pocket for covered medications before your plan starts to share the costs. While the deductible can vary by plan, Medicare caps it at $545 for any Part D plan.

Initial Coverage: After meeting your deductible, you enter the initial coverage stage, where you pay a portion of the cost for your medications according to a copayment or coinsurance structure. This stage continues until your total drug costs reach $5,030.

Coverage Gap (Donut Hole): Once you hit the initial coverage limit, you enter the coverage gap, commonly known as the donut hole. During this phase, you will pay a higher percentage of medication costs. You’ll pay no more than 25% of the cost for both brand-name and generic drugs until your true out-of-pocket (TrOOP) costs reach $8,000.

Catastrophic Coverage: After reaching your TrOOP costs, you move into the catastrophic coverage stage. At this point, your plan covers the cost of your medications for the remainder of the benefits year.

Note that your deductible might be less than the maximum $545 depending on your plan. Also, starting in 2025, the drug plan stages will become more affordable. The donut hole will be eliminated, and the initial coverage stage will be capped at $2,000. Once you reach this limit, you’ll transition to the catastrophic coverage stage, eliminating out-of-pocket costs for the rest of the benefits year.

The cost of your Medicare Part D plan varies based on the insurance plan, its coverage specifics, your location, and the medications you use. Along with the monthly premium, you’ll also need to account for deductibles, copayments, coinsurance, and expenses related to the coverage gap (donut hole).

On average, you can expect to pay around $55.50 per month for your Part D premium.

Standalone Medicare Prescription Drug Plan (PDP): If you have Original Medicare (Parts A & B) and no other creditable drug coverage, you can enroll in a PDP. This plan is separate from your Original Medicare and specifically covers your prescription medications.

Medicare Advantage Prescription Drug Plan (MAPD): If you’re enrolled in a Medicare Advantage Plan (Part C) that doesn’t include drug coverage, you may be automatically enrolled in an MAPD. This plan combines prescription drug coverage with your existing Medicare Advantage benefits, streamlining your coverage.

It’s important to assess whether you need a Medicare Part D plan. If you already have creditable drug coverage through an employer or retiree plan, you may not need additional Part D coverage. Be sure to evaluate your current coverage to avoid incurring a lifelong penalty on your Part D plan.

Medicare Part D plans are valid for the entire calendar year, but you have the opportunity to make changes during the Medicare Open Enrollment Period, which runs from October 15 to December 7 each year. If you choose a new plan during this time, it will take effect on January 1st of the following year, ensuring a smooth transition and uninterrupted access to your medications.

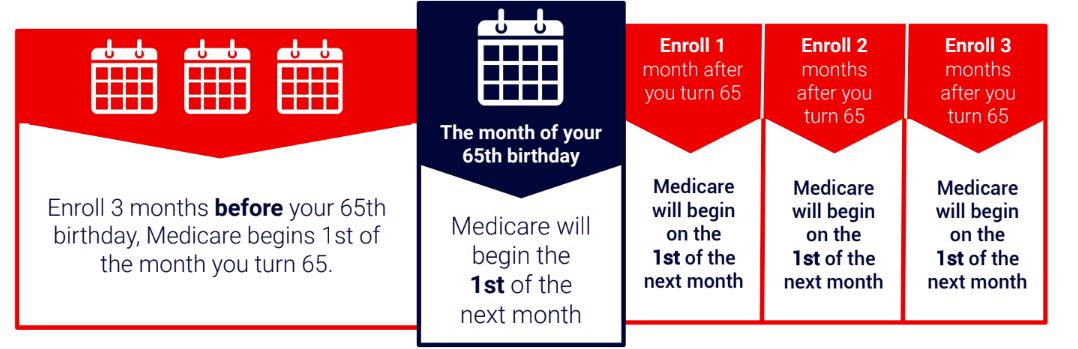

You also may sign up when you are turning 65 or first coming onto your Medicare Part B coverage.

Medicare Supplemental (Medigap) insurance typically does not include drug coverage. While some carriers may offer limited prescription drug benefits, most Medigap plans do not. Therefore, you will likely need to enroll in a separate Medicare Part D plan to ensure you have comprehensive drug coverage.

Whether you need a Medicare Part D plan in addition to your Medicare Advantage plan depends on whether your Advantage plan includes prescription drug coverage. Most Medicare Advantage plans include drug coverage and are known as Medicare Advantage Prescription Drug Plans (MAPDs). If you’re enrolled in an MAPD, your prescription needs are typically covered, and you won’t need a separate Part D plan.

However, if your Medicare Advantage plan does not include drug coverage, it is advisable to enroll in a separate Medicare Part D plan to manage your medication costs effectively.

TRICARE provides its own pharmacy benefits, allowing you to fill prescriptions at military pharmacies, through TRICARE’s home delivery service, or at network retail pharmacies. These benefits typically cover a wide range of medications, similar to what a Medicare Part D plan offers.

However, there are exceptions. For instance, if you select a TRICARE plan that does not include prescription drug coverage or if you relocate to an area with limited TRICARE pharmacy access, you might need to enroll in a Medicare Part D plan to ensure continuous medication coverage. It’s a good idea to review the specifics of your TRICARE plan and consult with a Medicare advisor if you have questions or concerns about your prescription drug coverage.

No matter when you choose to enroll in Medicare, Martindale Financial Group will be here to help you.

We help you understand your eligibility and determine the best time to enroll in Medicare based on your unique circumstances.

At Martindale Financial Group, our mission is to make Medicare easy to understand so you can enjoy your retirement with confidence. Explore our blog or visit our YouTube channel for valuable info on Medicare and Social Security.

For personalized assistance, schedule an appointment with a us or give us a call today.

Dain Martindale is an Independent Insurance Agent offering Medicare, Life, and Health care products at affordable rates and can write policies for most major carriers. Licensed in Florida serving the Tarpon Springs community and beyond.

Copyright © 2024 Martindale Insurance Services DBA Martindale Financial Group. All rights reserved

Currently we represent most major carriers in your area. You can always contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) for help with plan choices.