Knowing when and how to sign up for Medicare can be confusing. But it doesn't have to be. Understanding your unique situation can help you make the most of the available Medicare plans available. Ensuring your peace of mind and protection during retirement.

You and your spouse’s employment status is key in deciding the right time to enroll in Medicare. By examining different scenarios, you can make a more informed choice. Here’s a guide to understanding when to sign up for Medicare based on your current employment and health coverage.

Yes, you can have both employer insurance and Medicare, but there are a few important details to keep in mind.

If you or your spouse work for a company with fewer than 20 employees, you must enroll in Medicare because your employer’s insurance will become secondary once you are Medicare-eligible.

If you or your spouse work for a company with 20 or more employees, you can choose to delay Medicare enrollment, as your employer’s insurance is considered creditable coverage. This gives you a Special Enrollment Period (with no penalties) to sign up for Medicare later when you’re ready.

Should you decide to enroll in Medicare Part A and/or Part B, your employer’s insurance will remain your primary coverage. The choice to sign up for Medicare should be based on a comparison of your employer plan’s benefits and costs with those of Medicare.

If you’re on a COBRA plan, you need to enroll in Medicare when you turn 65. Although COBRA offers temporary coverage, it can be expensive and is not ideal for long-term use. Once you’re eligible for Medicare, COBRA will become secondary coverage, which means you’ll be responsible for paying first unless you sign up for Medicare. Additionally, COBRA is not considered creditable coverage by Medicare standards, so if you don’t enroll at 65, you will face permanent penalties and delayed enrollment issues.

Book a free call by clicking or tapping below or give me a call at: 727-513-2767

If you have an individual health insurance plan under the Affordable Care Act (ACA), you benefit from tax subsidies and cost-sharing, which make the plan quite affordable. However, once you turn 65, these subsidies and cost-sharing benefits end, leaving you responsible for paying the full premiums and out-of-pocket costs. In this case, transitioning to Medicare makes more sense, as you cannot receive subsidies from both Medicare and ACA plans simultaneously.

TRICARE is renowned for its broad coverage, but if you’re a military member with this insurance, you must enroll in Medicare when you turn 65. Similar to COBRA, TRICARE will become secondary coverage once you’re eligible for Medicare. This requirement also applies to eligible family members of military personnel.

Medicare has several enrollment periods and all of them function differently depending on your specific circumstances

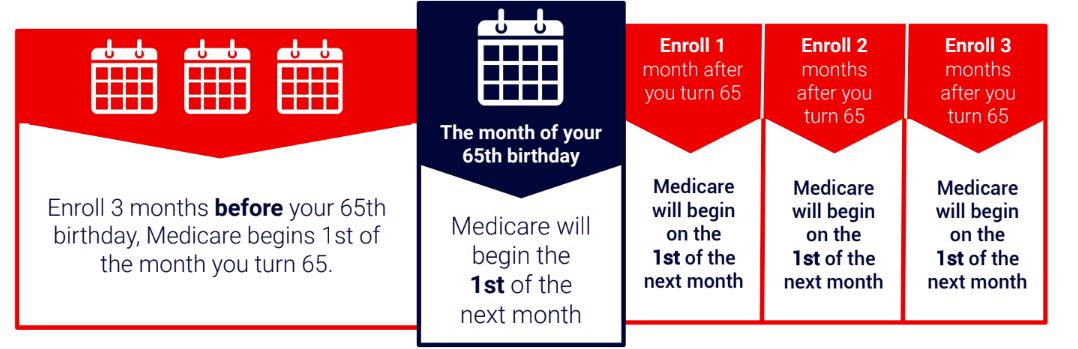

The Medicare Initial Enrollment Period begins 4 months before you turn 65 and runs 3 months after you turn 65, for a total of 7 months. The Initial Enrollment Period is the best time to select a Supplemental Plan because you can enroll without any medical underwriting and enroll in Part B with no penalties.

The Medicare Special Enrollment Period (SEP) allows you to sign up for Medicare outside of your Initial Enrollment Period (IEP) under certain circumstances. Qualifying situations for an SEP include moving out of your Medicare Advantage service area, continuing to work past age 65 with creditable coverage, or losing employer-sponsored health insurance.

The length of the SEP depends on your specific situation, ranging from as short as two months to as long as eight months.

The Annual Enrollment Period (AEP) runs from October 15th to December 7th. This is the time period when you can make changes to your Medicare Advantage and Prescription Drug Plans. Any adjustments you make during the AEP will be effective starting January 1.

The Medicare Open Enrollment Period (OEP) functions similarly to the open enrollment period for Medicare Advantage plans, and it’s also known as the Medicare General Enrollment Period. Running from January 1 to March 31, this period allows those who missed their Initial Enrollment Period (IEP) or do not qualify for a Special Enrollment Period (SEP) to enroll in Medicare Part A and Part B. As well as change their plan if they are not satisfied with the one they chose during AEP. However, enrolling during the OEP may result in a lifelong penalty on your Part B premium.

No matter when you choose to enroll in Medicare, Martindale Financial Group will be here to help you.

We help you understand your eligibility and determine the best time to enroll in Medicare based on your unique circumstances.

At Martindale Financial Group, our mission is to make Medicare easy to understand so you can enjoy your retirement with confidence. Explore our blog or visit our YouTube channel for valuable info on Medicare and Social Security.

For personalized assistance, schedule an appointment with a us or give us a call today.

Dain Martindale is an Independent Insurance Agent offering Medicare, Life, and Health care products at affordable rates and can write policies for most major carriers. Licensed in Florida serving the Tarpon Springs community and beyond.

Copyright © 2024 Martindale Insurance Services DBA Martindale Financial Group. All rights reserved

Currently we represent most major carriers in your area. You can always contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) for help with plan choices.